. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||||

|

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp DeCom Markets FOMEZ GPEUN LED - Hubs GOMTX RingLink SODA FEV Economic Engine UDC Smart Contracts DFDC UDI PriceDemand |

||||||||

| Global Chamber of Economies - focused on Localization | ||||||||

|

||||||||

| Cloudfunding shifts the economics | ||||||||

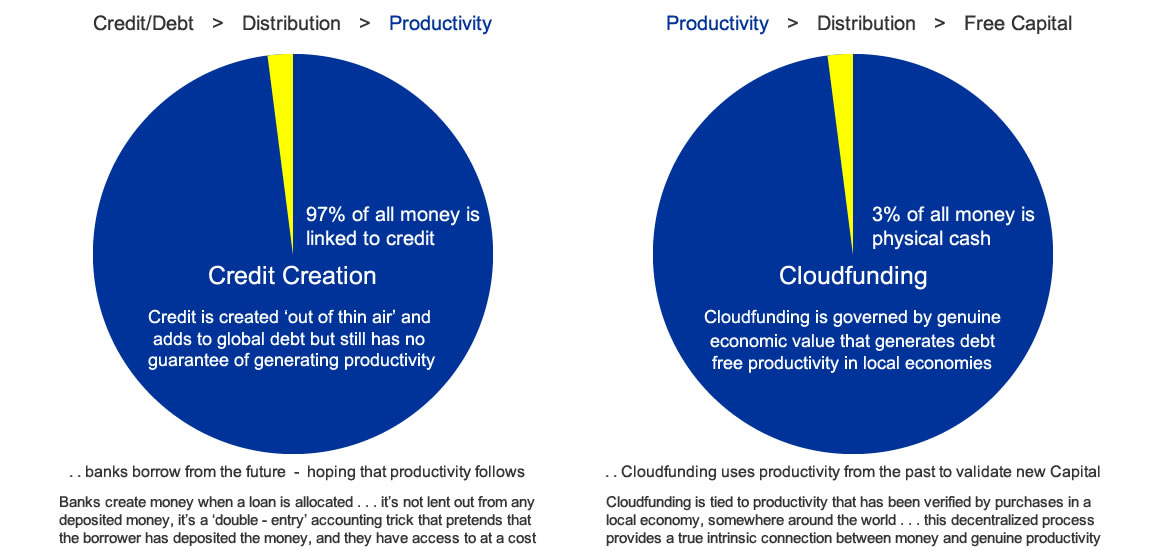

Cloudfunding has no trailing debt like Credit Creation In never ends well for local economies when credit creation, which banks use to create money from nothing and lend to local users, when the indebtedness repeatedly overwhelms the society - this form of slight of hand accounting is the very accounting instrument that causes the frequent booms and busts in local economies and at various regional levels - in credit creation, no physical money is actually transferred from a bank's deposits or from its central reserve system for lending, only new credit is created from nothing ( out of thin air ), just on the judgment of the banks. This credit creation, which began in earnest in the 1980s and has escalated ever since, is a cost-extraction and not a value-added service to economies - when credit is created as loans it's typically tied to collateral in property or plant, of which the ownership is transferred to the bank for the length of loan in case of defaults - that transfer of ownership is to reduce the risk taken by the bank when they use the traditional double entry bookkeeping to simply add numbers to fund the borrower's account as a loan, one side of the ledger is the withdrawable amount and the other side is the loan debt - in the case of credit cards there is often no collateral directly held but control is gained indirectly by the credit rating system - what is not generally known is that the amount of the loan that's simply added into the borrower's account is referred to as a deposit made by the borrower, which is a switch in accounting terms to make the bank's books look better with increased deposits of capital, when in fact it was simply numbers added to an account ledger. This essentially means that the collateral is liquidated to withdrawable money that the bank created 'out of thin air', not transferred from any actual deposited monies made by the borrower or other depositors - the switch in terms from loaned money to deposited money means that the banks can refer the money as being lent by the depositor ( borrower ) to the bank, which the borrower can withdraw as if it was their own money - this is when the bank changes the classification of the deposit ( loan ) to a security that is used by the bank to trade with other banks - these securities are added to the bank's own asset base, and because of the re-classification in the naming of the asset, it allows the banks to trade them as financial securities ( as derivatives or IOUs ) between each other internationally. Credit Creation never returns profits back to local economies The ease in which credit is created is what tips economies into boom and bust cycles ( known as credit cycles ) because there's no governance tied to the flow of credit ( money supply ) back into local economies that can be genuinely connected to true productivity - the creation of the credit comes down to an individual or small group of people who decide whether the borrower is an acceptable risk, it has little to do with whether there will be anything productive coming from the lending - creating credit for a loan to buy a house or any number of existing assets is not productive, as it's merely an exchange of ownership of an asset - with or without collateral the bank's business model allows the bank to 'double dip', first by creating credit as a loan that they extract interest from, and that same loan that was switched to a deposit ( money lent to the bank by the borrower ) is used as a security to speculate with in the financial markets ( ever wondered who the currency traders were and where they get their money ). The customer has become the product of the banking system The risk management that banks have is when they themselves 'borrow' against those new loans ( listed as deposits / securities on their books ), they need to have constant repayments made by the initial borrower to service the loan and more importantly the creation of more credit so the banks can continue funding their foreign dealings - this foreign investment is mixed with an expanding 800 billion dollars worth of derivatives ( IOUs between banks ) that global banks are juggling between each other in an unregulated market that are based on future returns on loans etc to keep their financial markets operating - any returns from these foreign investments never re-enters or is used in the local economies for any productive use, it swirls around in derivatives and other exotic financial deals funded by the initial borrowers to speculate with ( think GFC ) - even the interest charged for the loans and becomes the bank profits are shared with a relatively small number of shareholders and the bank executives - it offers good evidence as to why the developed countries are now finding that productivity growth is weakening, wages have stagnated on and off since the 1980s, but private and public debt is only rising, with only banks being profitable. Creating credit so easily, hasn't translated into any type of distributed wealth In the boom times, larger volumes of credit are created by the eager banks, with numbers just being added to a borrower's bank account, not drawn from deposits or transferred from the bank's reserves held elsewhere, it just numbers added to the local money supply - this then allows real money ( local cash money and digital ) from inside a local economy's wealth base to be transferred out of the local economy to the bank's central reserve system. Being able to create credit so easily hasn't translated into a trickle down effect over the last four decades - what had been a constant narrative up to the 1980s, when a single household income could support the family and pay a mortgage or rent - that's now changed with two ( or more ) incomes needed for a household to achieve the same result, even though there's the obvious extra quantity of devices attached as sweeteners to make up for the extra burden being carried to try and pay off the increased debt. Our current economic landscape was supposed to be about 15 hour work weeks and time for discovery, a type of Renaissance Period, instead we fell into a true feudal system where whole societies are paying rent-seekers to use a money system that is created out of thin air - it's not as if they're leading everyone to a better place by temporarily making societies carry the burden of an increasing debt now, and to make it easier for later, this is it, where a typical family needs to have two parents working to have a lifestyle similar to others around them - and then passing that same process on again, with more disadvantages, to the next generations - if the rent-seekers had a plan to give societies an easier pathway they would have solved the recession cycles and do it without the indebtedness, instead they keep shifting the goal posts and telling people to keep digging deeper if they want the lifestyle. Dilution in the value of money shouldn't be underestimated The switch from using real cash money to a credit form of currency that continuously circulates in bank accounts in the local economy costs almost zero, but instead there're fees being charged for its use - this extraction of local wealth value is never returned to the local economy in real cash money, it's now the profit of the institutions and it's shared across the institution's shareholders and executive pay and bonuses - with more credit being needed to replace the extracted value - this dependency for credit creation cycle is repeated until asset prices reach a limit and the next inevitable bust or down-turn occurs, stripping asset value from the local wealth and adding to the inequality gap in the overly indebted local communities. The value of real cash money is different to the credit form of currency - over a relative short period of time the value of the credit form of money is diluted to zero, unless there's productivity generated from that created credit - proof that this model doesn't translate into genuine productivity and wealth is the massive increase of the credit needed each time there's a crisis, and more to the point, the increase in debt that both public and private sectors have to carry - this escalation in creating so much credit over the last decade since the GFC ( known as the great financial experiment ), without it being based on any true productivity, has resulted only in multiplying global debt and shifted that debt onto governments and communities. The unwinding or slowing of the quantitative easing QE around the world is the next experiment - the problem however is the value of money that was injected into the banking systems has already been shifted and distributed, and systematically pocketed by those up in the top echelons - and so any withdrawal from the money supply is only a formality to square the Central Bank's books but it's still to the detriment of the societies carrying the systems' debt through taking on so much credit, be it at low interest rates, but overall it was to help generate Productivity - the debt will incrementally be charged higher rates, and not disappear as the money supply withdrawals continue to get back to 'normal', that leaves more credit creation needed to service the loans - the problem now is that the existing indebtedness remains and a further expansion of credit creation is needed to support the previous debts - somewhere along the line the volume of Productivity needs to be found to support the debt. As the $22 trillion US Dollars worth of cheap printed QE money that was added into the financial system by the central banks since the GFC is slowed and even removed ever so slowly, the Catch 22 is that the debts created by the low interest rates still remains for the corporates that borrowed to buy back shares and given as dividends, and the private borrowers who borrowed for real estate or shares, these loans still need to be serviced from profitable Productivity, not just from inflated asset prices, as what's been happening. |

||||||||

| Banking Cloudfunding | ||||||||

| > Credit/Debt - Distribution - Productivity > Productivity - Distribution - Free Capital | ||||||||

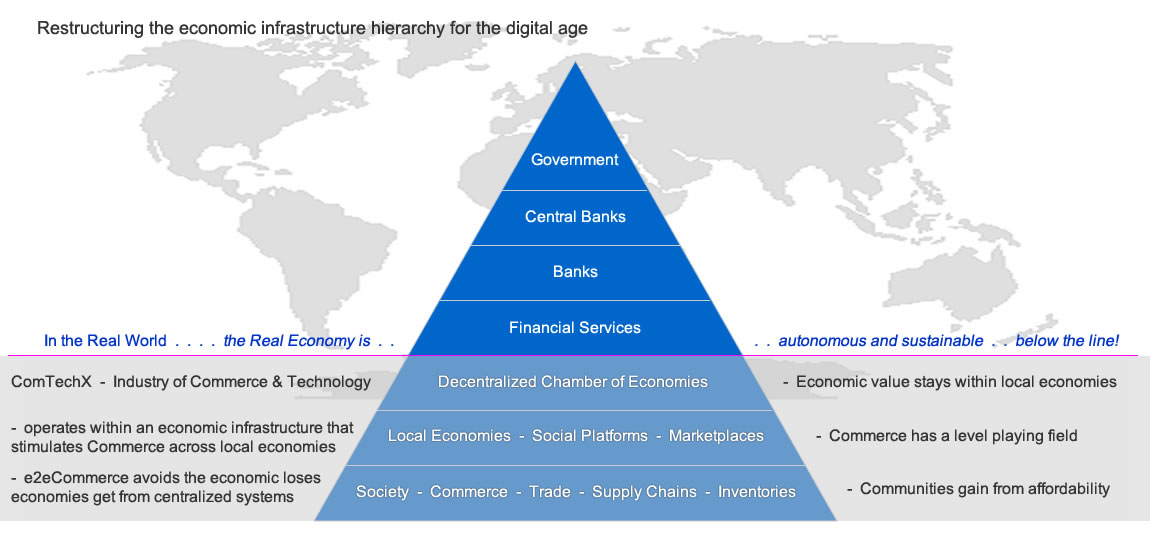

Cloudfunding separates Capital from risk-taking bankers Ever since the 1980s and the deregulation of the financial and banking system when credit creation mainly took off, there was also a merging of risk-taking across the available capital flowing through the economies - domestic and investment banking has totally merged during this century ( Glass-Steagall Act repealed in 1999 ) bringing with it the ability to join the efforts ( of income savings of working people ) from the real economy with the investment world's capital, and together it's used to gamble with by the growing financial sectors in developed and developing countries - local Chamber of Economies use Cloudfunding, which is designed to operate separately from the financial and banking system, by remaining directly and specifically in commerce and trade activity. The financial sectors of most developed economies has been growing since the GFC, and the incentives have returned to pre GFC times - a recent statistic from the USA, showed that the financial sector was 7% of the economy ( in some countries it's 12 to 15% ), it creates only 4% of all jobs, but it takes 25% of all corporate profits - and as the financial sectors' size increases, so does the amount of corporate profit, enabling it to dominate other industries with its control over Capital flows and services - it's a rent-seeking industry that skews economies as there's no value-added back to the GDP, it extracts value from the real economy but only for the benefit of a few. Community consensus controls local Chamber of Economies Cloudfunding changes the structure of how Capital flows into economies by moving Productivity from the last position ( where it is in Credit Creation), and places it as the leading function and catalyst to generate new Productivity - this change to how Capital begins to flow into local economies begins with users from anywhere being funded with free economic value just by Opting-In to a distribution of inventory value via subliminal advertising - this opens up to a new sustainable growth with genuine Productivity governing the amount of Capital entering the local economies, which provides the scarcity of money, a neutral medium of exchange and a stable store of value - with Outsourced Selling for sellers and Price Demand for buyers being the incentives to drive growth. Communities gain the technology to counter the inequality that's been building over the last decades when they help to establish local Chambers to expand the Global Chamber of Economies - building out the alliance can bring new levels of economic growth to local economies by giving local communities direct control over wage growth along with better buying power to deleverage away from credit and debt and offset the inflation of prices. Accountable and Democratic - for the common good Cloudfunding is a totally new economic model, it keeps the flow of Capital within the mechanisms of Commerce by changing the way Capital flows between buyers and sellers when generating productivity - it does it by digitizing the existing money in local economies by initially outsourcing the selling of genuine inventory by converting the full selling prices into micro-values prior to the products reaching the local buyers, without taking the real physical money out of circulation - it mirrors ( digitizes ) the local currencies with Pay It Forward, Now! when sellers liquidate their sales, then increases that amount to the money supply in the local economy with an additional flow of Capital by incentivizing verified foreign Capital from other economies using a democratic process that monetizes local products and services, which then flows through to stimulate productivity across multiple local economies interconnected along the Global Public Utility Network. Businesses are judged on their actions What provides the balance between the sellers getting full selling prices by outsourcing the selling of inventories and the buyers using Price Demand to pay buying prices at what they want or can afford, is the Global Crowd, positioned between the buyer and seller, with the ability to deny both sides the opportunity of completing a sale - this position is unique and the new market makers who can replace share market traders across all the global markets of trade and commerce - it provides a new ecosystem that places the supply side in the position where the sellers need to be conscious and more aware of being socially judged ( as in negative social media ) when delivering products and services - ensuring that it's beneficial to the buyers and in the best interest and common good of society. This new Capital flow is unique in economies because it's able to be tracked ( RingLink technology ) down to 14 decimal points back to its origin, where it's verified and validated from productivity across all the Global Chamber of Economies - Cloudfunding uses a basket of global currencies to constantly set an aggregated value for a neutral international unit of account to have a stable currency value across all the local economies - this means there's no dilution of buying power locally, and it creates no inflation because there're no fees that dilute value and buying power - it remains in the real local economy as part of the local money supply. |

||||||||

|

||||||||

|

||||||||

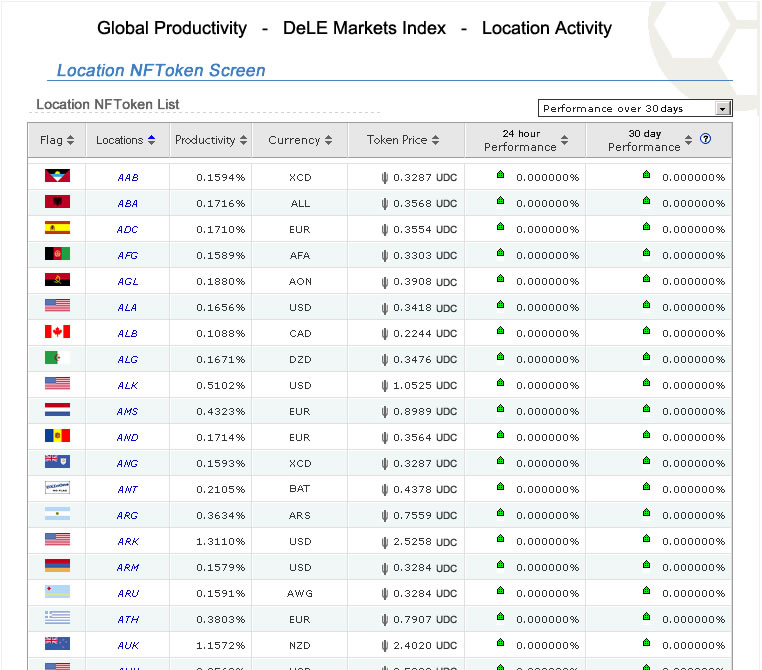

A neutral international trading unit helps raise the velocity of local currencies Cloudfunding changes the flow of Capital in local economies by drawing in foreign digital Capital without transferring local currencies across borders - this shift in international units of account moves trade and a neutral trading currency from economy to economy without costly incumbents - local sellers gain the competitive advantage with full selling prices, and buyers gain the buying power with prices they want to pay. Cloudfunding disrupts the equilibrium of supply and demand mechanics by separating the selling price in supply and the buying price in demand - this means that instead of the supply leading by discounting to find the demand, supply's full selling prices are fully monetized via new Capital flows, leaving the competitiveness between buyers to find the demand's real time ( discounted ) buying price. Shifting the discounting to the demand side generates greater Capital flows on the supply side where increased productivity gains more tax revenues from increased velocity of local currencies spreading across communities - the supply sides' full selling prices fend off any potential economic slow down ( caused when discounting stifles economic growth ) with more predictable revenue that can keep wage growth and business Capital Investment in line with productivity. The Global Chamber of Economies indexes all the local economies with real time updates on productivity across the various industry supply chains - each listed Location gains an activity tax ( wealth tax ) that's distributed to users as Universally Decentralized Capital, which acts to correlate the demand value with the true productivity supply and costs, and keeps inflation at bay, as it's constantly added to a user's Universally Distributed Income portfolio in real time. While the Direct Foreign Decentralized Capital has the connection directly with an economy there's also Free Direct Backing that global users can directly back businesses and entrepreneurs with the expansion of a business or venture. e2eCommerce moves ubiquitously across borders in the real economies With trade moving ubiquitously from economy to economy there's obviously the exchange of value that goes with it - the change that Cloudfunding makes with the way Capital flows in an economy changes the way Capital moves from economy to economy and across borders - because Cloudfunding keeps local cash circulating in the local economy, and securely tracks the ownership of the digital cash, this allows all exchanges and transfers ( remittances ) to cross borders without costs or barriers, other than the KYC and AML requirements. This true cashless and fully accountable ecosystem changes the game and is a huge advantage for businesses with reduced costs of doing international trade ( and for personal use ) - as a neutral international trading unit of account, with its value being the aggregation of global currencies to constantly remain stable, it reconciles international trading of assets and liabilities in real time without involving the cost of issuing credit or debt. |

||||||||

| CloudfundMe Sellers - Global Crowd - Buyers |

||||||||

|

||||||||

| Global Chamber of Economies - Global Open Market Index | ||||||||

| Location Activity by Industries Location Analytics | ||||||||

ComTechX |

|

|

||||||

more |

||||||||

| About Us Contact Privacy Policy Terms of Service |

||||||||